Local News

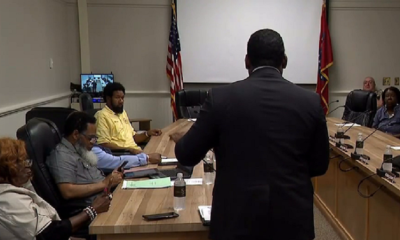

Arkansas legislators discuss first day of special session

Little Rock, Arkansas – On Monday morning, the first extraordinary session presided over by Governor Sarah Sanders began.

Lawmakers traveled to Little Rock to talk about a variety of issues affecting Arkansans.

Changes to the state’s FOIA rules, which allow anybody to ask for documents from public authorities, are arguably the two biggest topics. Potential amendments to the state’s income tax legislation are also significant.

On Monday afternoon, the committee approved the Senate version of the bill, which was sponsored by Senator Jonathan Dismang (R-Beebe).

“It’ll be on our floor tomorrow, and we’ll send it over to the House and let them dispose of the bill,” he said. “Again, I don’t expect that we’ll have any road bumps.”

If enacted, the possible tax cuts would alter tax rates for many Arkansans. The House version of the bill was sponsored by Republican representative Les Eaves of Searcy.

“Keep Arkansas competitive, so this time, our proposal would be to reduce the personal income tax rate down to three-tenths of a percent,” Eaves explained. “Then also on the corporate side, down three-tenths of a percent.”

Individual rates would decrease from 4.7% to 4.4% as a result, and corporate rates would decrease from 5.1% to 4.8%. These bills would also provide a $150 tax credit to anyone with an annual income under $90,000.

Eaves and Dismang cited our state excess as justification for moving things along.

“I know there’s some folks that would really like the state of Arkansas to keep that and spend that, but in my personal opinion and I hope my colleagues, we’re gonna be sending that back to Arkansas taxpayers,” Dismang described.

Others are against the bill.

Greg Leding, a state senator from Fayetteville, stated that he doesn’t understand the urgency.

“I see no urgent need for this special session,” Leding said. “Back in early August, Republican leaders said tax cuts could wait until early 2024, and yet here we are just about a month later.”

-

Local News2 weeks ago

Local News2 weeks agoArkansas State Police seize over 4,000 pounds of illegal drugs in highway traffic stops

-

Local News2 weeks ago

Local News2 weeks agoJefferson County is dysfunctional due to a dispute between the judge and justices

-

Local News2 weeks ago

Local News2 weeks agoLittle Rock and North Little Rock will see lane restrictions along Interstate 30

-

Local News2 weeks ago

Local News2 weeks agoSeveral recently painted murals in Little Rock’s downtown

-

Local News2 weeks ago

Local News2 weeks ago$20 million grants will be funded by the Arkansas Department of Human Services for pilot project

-

Local News7 days ago

Local News7 days agoMay Fest 2024 promises a joyful street

-

Local News2 weeks ago

Local News2 weeks agoA church in Fredonia becomes a museum with a mission of conserving African American history

-

Local News2 weeks ago

Local News2 weeks agoThe 50th season of the Little Rock Farmers Market begins

Leave a Reply